GoDaddy Inc. announced its financial results for the first quarter (Q1/2025) ending March 31, 2025.

The company highlighted strong performance in Q1 and reaffirmed its outlook for the year, emphasizing its consistent execution and resilient business model.

GoDaddy also completed its 2022 share repurchase program, retiring over 25% of its fully diluted shares, and introduced a new $3 billion multi-year buyback plan extending through 2027.

Leadership underscored the company’s long-term positioning, noting its continued focus on delivering measurable value to customers and shareholders despite broader economic conditions. Stock is up in after hours trading.

First Quarter 2025 Business and Financial Highlights

- Total revenue of $1.2 billion, up 8% year-over-year on a reported and constant currency basis.

- Total bookings of $1.4 billion, up 8% year-over-year, and 9% on a constant currency basis.

- Applications and Commerce (A&C) revenue grew 17% year-over-year to $446.4 million.

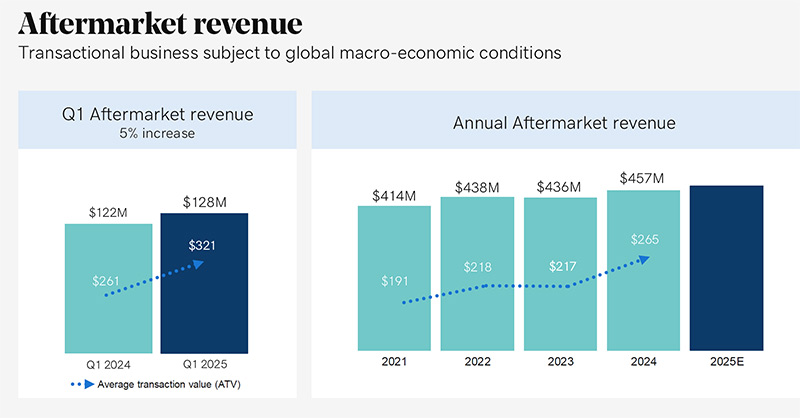

- Core Platform (Core) revenue totaled $747.9 million, growing 3% year-over-year.

- Operating income of $247.3 million, up 40.6% year-over-year, representing a 21% margin.

- Net income of $219.5 million versus $401.5 million in the prior year. Net income in each period was inclusive of non-recurring, non-cash income tax benefits of $34.6 million and $267.4 million, respectively.

- Normalized EBITDA (NEBITDA) of $364.4 million, up 16% year-over-year, representing a 31% margin.

- Net cash provided by operating activities of $404.7 million, up 36% year-over-year.

- Free cash flow of $411.3 million, up 26% year-over-year.

- Expanded the reach of GoDaddy Airo® to new on-ramps, including logos and email, and continued to enhance the premium features available in Airo Plus.

- Announced the launch of GoDaddy Agency, a new partner program connecting digital agencies with small and mid-sized business leads and providing access to comprehensive tools, services and support to grow their client offerings.

Balance Sheet

As of March 31, 2025, total cash and cash equivalents were $719.4 million, total debt was $3.8 billion and net debt was $3.1 billion.

Business Outlook

For the second quarter ending June 30, 2025, GoDaddy expects total revenue in the range of $1.195 billion to $1.215 billion, representing year-over-year growth of 7% at the midpoint versus the same period in 2024. For the full year ending December 31, 2025, GoDaddy reaffirms its guidance, expecting revenue in the range of $4.860 billion to $4.940 billion, representing year-over-year growth of 7% at the midpoint, versus the $4.573 billion of revenue generated for the full year ended December 31, 2024. Within total revenue, GoDaddy expects second quarter and full year A&C revenue growth in the mid-teens and Core revenue growth in the low single digits.

For the second quarter ending June 30, 2025, GoDaddy expects NEBITDA margin to be approximately 31%. For the full year ending December 31, 2025, GoDaddy expects NEBITDA margin expansion of approximately 100 basis points.

For the full year ending December 31, 2025, GoDaddy expects free cash flow of at least $1.5 billion, versus the $1.4 billion of free cash flow generated in 2024.

GoDaddy’s consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States (GAAP). GoDaddy does not provide reconciliations of forward-looking non-GAAP measures to the most directly comparable forward-looking GAAP equivalents, because projections of changes in individual balance sheet amounts are not possible without unreasonable effort, and presentation of such reconciliations would imply an inappropriate degree of precision. For non-forward-looking non-GAAP measures, a reconciliation to the nearest GAAP equivalent is included in this press release following the financial statements.

For the full report click here.

Loading...

Loading...