The GoDaddy appraisal tool produces its domain valuation reports by using a “secret sauce” algorithm.

Every time you end up on the GoDaddy appraisal tool, perhaps after googling “Domain appraisal,” the following message is hiding behind an alert icon:

GoDaddy estimates the value of each domain by looking at millions of historical domain name sales. The estimated value may or may not rely upon this particular domain’s sales data, as the domain may not have previously sold. Sellers may ask, and you may ultimately settle, for a price below or above this estimated value.

Of course, there’s also a disclaimer that accompanies these domain valuation reports, just in case you plan to sell your domain based on GoDaddy appraisals.

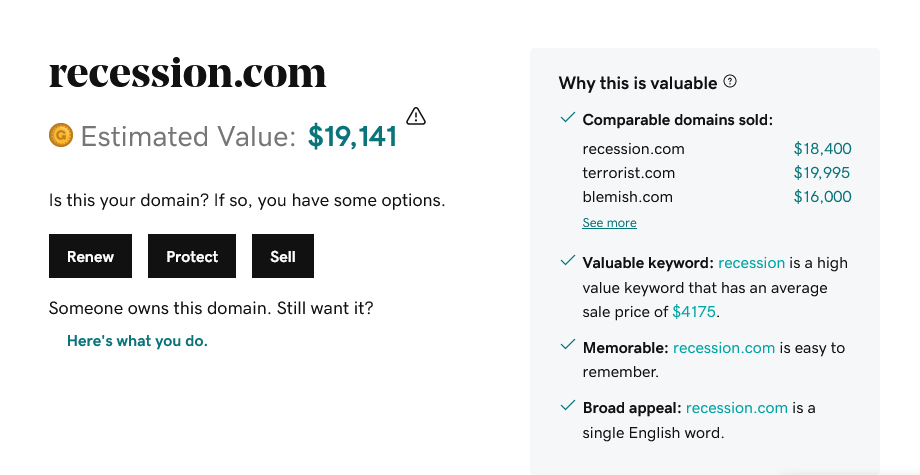

We used the GoDaddy appraisal tool to estimate the value of the ultra-premium, newsworthy domain name, Recession.com.

Primarily, because the subject of recession in the US and globally is the current popular keyword in financial markets, following the ongoing inflation. In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending.

So Recession.com scored a surprisingly low $19,141 dollars at GoDaddy, which is known to project higher numbers with a “$25,000 minimum” response.

But this sub-$20k price isn’t the most interesting part that the GoDaddy appraisal tool churned out.

Right next to the report, under “Comparable domains sold,” we see the same domain, Recession.com, with a price of $18,400 dollars.

Given how Recession.com was indeed sold by the GoDaddy portfolio holder of domains, NameFind, in the summer of 2018, one would think that indeed, that was the actual selling price of Recession.com.

Of course, we have no other proof but it makes sense, doesn’t it? The GoDaddy appraisal tool is expected to use real, verified data for its appraisals, after all.

Recession.com is an active platform for financial services that has used the domain since the sale took place in 2018.

Copyright © 2025 DomainGang.com · All Rights Reserved.