NFT collectibles mixing art and childhood cards are rolling platforms such as OpenSea with millions of dollars in daily transactions.

The bag of winds opened up with the introduction of the blockchain and cryptocurrencies, enabling transactions to occur outside of the regulated banking system.

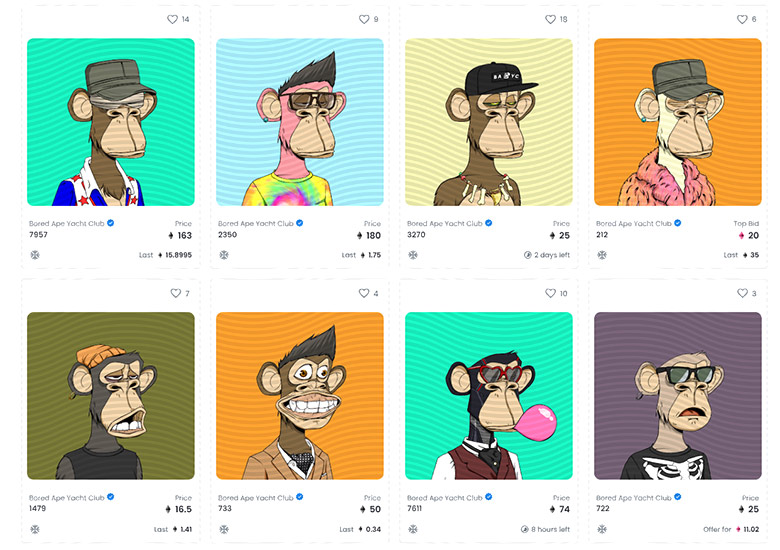

Non-fungible tokens and their appeal to tens of thousands of aspiring art-collectors and sports memorabilia fans generate almost $200 million per day at OpenSea, according to the latest reports.

But is the NFT craze a pyramid scheme and a money laundering system, or a legitimate need to belong to a group of digital collectors and fans?

So far, the IRS has not released exact guidelines regarding how NFTs are regulated, but according to some, transactions that involve the sale of NFTs and subsequent acquisition of other digital tokens with these proceeds is a taxable event.

Meanwhile, domain investors put their money into a variety of NFT collections, such as the Bored Ape Yacht Club, World of Women, Cryptopunks, and others. Some have generated hundreds of thousands of dollars by flipping “JPGs” of apes, penguins, cats, rocks, and other digital art existing only on the blockchain.

The truth is, one does not need thousands of dollars to acquire tokenized art. Real media artists, such as Merce Yacante, offer their real paintings on the blockchain, combining a digital certificate of ownership with the real item.

Domain investors such as Mike Cyger have found a novel way to offer their premium domains for sale; Mike’s recent listing of Pyramid.com for a cool 1000 ETH is another demonstration of the opportunities opening up to domain investors.

Copyright © 2025 DomainGang.com · All Rights Reserved.

When it comes to the US, I am not sure that there is really a serious debate…basically any time you sell anything for a profit it is income, and a taxable event.

This is not something that really needs specific guidance. It is like selling anything else for a profit.

The means of payment don’t really matter that much. It would just be converted to market value of the payment when it comes to taxes.

Brad

Brad – The argument is about selling for (crypto)money vs. trading. Indeed, when a sale occurs, that transaction is a taxable event. The link I provided has some interesting info on how the IRS is licking its chops for NFT holders, much like with crypto trading.

The IRS will treat whatever the payment method is cash, gold, crypto, etc. at market value when it comes to taxes.

If that wasn’t the case you could just sell whatever you wanted for a profit and take cryptocurrency as payment then never report the profits as income.

There is a specific cryptocurrency question on the IRS form now. It is on their radar.

The recent legislation in Congress is going to make the exchanges start reporting the transactions as well.

If people can make money on these, more power to them…but if they think they can avoid declaring income good luck with that.

Brad

Brad – Of course. Crypto was the first to be taxed and NFTs are next. A lot of investors hold onto these assets long term while they appreciate; that taxable event, should it occur past the year point, might as well qualify as a capital gains transaction.

We are living in exciting times!

“Charlie bit my finger and then sold me an Nft that will never get a positive return?

DomainGang: I think what you meant to say with that was that it is a long-term capital gain after the year mark. Stating it like that sounds like anything before that is a non-taxable event, when it is, however, a short-term capital gain which is taxed at a higher rate. Just a clarity point for those that are not in the know about this (short vs. long and the tax rates between the two). Enjoyed, cheers!

I am saying ……..what a waste of money, stay well.