NFT collectibles mixing art and childhood cards are rolling platforms such as OpenSea with millions of dollars in daily transactions.

The bag of winds opened up with the introduction of the blockchain and cryptocurrencies, enabling transactions to occur outside of the regulated banking system.

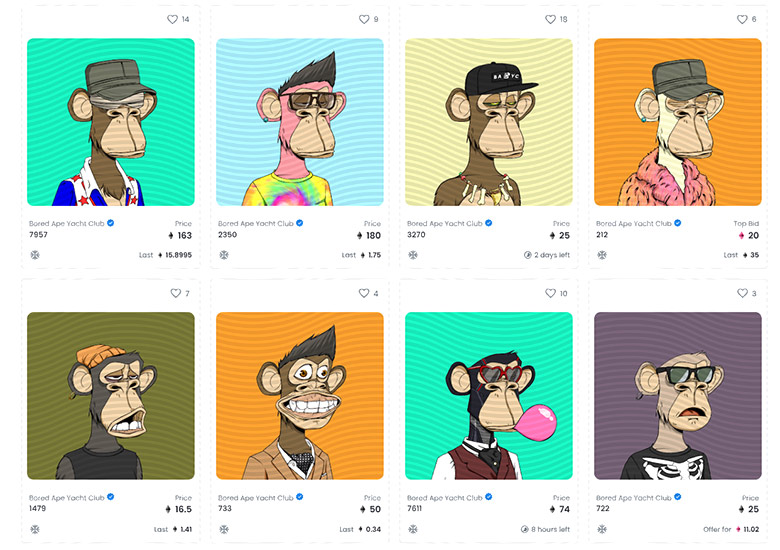

Non-fungible tokens and their appeal to tens of thousands of aspiring art-collectors and sports memorabilia fans generate almost $200 million per day at OpenSea, according to the latest reports.

But is the NFT craze a pyramid scheme and a money laundering system, or a legitimate need to belong to a group of digital collectors and fans?

So far, the IRS has not released exact guidelines regarding how NFTs are regulated, but according to some, transactions that involve the sale of NFTs and subsequent acquisition of other digital tokens with these proceeds is a taxable event.

Meanwhile, domain investors put their money into a variety of NFT collections, such as the Bored Ape Yacht Club, World of Women, Cryptopunks, and others. Some have generated hundreds of thousands of dollars by flipping “JPGs” of apes, penguins, cats, rocks, and other digital art existing only on the blockchain.

The truth is, one does not need thousands of dollars to acquire tokenized art. Real media artists, such as Merce Yacante, offer their real paintings on the blockchain, combining a digital certificate of ownership with the real item.

Domain investors such as Mike Cyger have found a novel way to offer their premium domains for sale; Mike’s recent listing of Pyramid.com for a cool 1000 ETH is another demonstration of the opportunities opening up to domain investors.