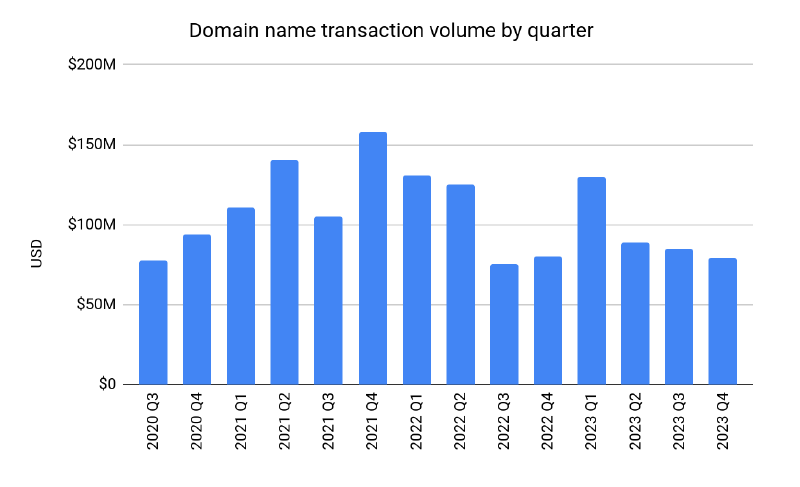

In the fourth quarter of 2023, Escrow.com witnessed a slight decline in total domain name volume, decreasing from $85 million dollars in the third quarter to $79 million dollars. Across most domain categories, the median prices have remained consistent compared to the preceding quarter.

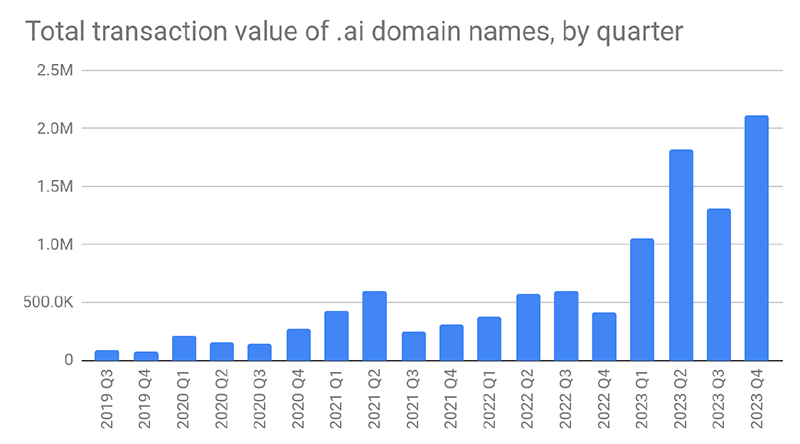

Noteworthy highlights from this period include the volume in sales of .AI domain names reaching a new record high value of $2.1 million dollars in Q4/2023.

Meanwhile, the median price of four-character .com domains experienced a notable increase, going up from $10,000 dollars in the third quarter to $13,000 dollars in the fourth quarter, setting a new record.

In summary:

The aftermarket domain market continues to be significantly influenced by venture capital investment. Over the past two years, the venture ecosystem has undergone substantial changes, marked by a record-breaking surge in funding activity in 2021 followed by a market slowdown in late 2022 and throughout 2023. Projections for 2024 anticipate a stabilization in venture funding levels after a period of turbulence.

The outlook:

Looking ahead, the global venture capital ecosystem is expected to undergo continued diversification, with emerging markets, deep tech startups, DeFi platforms, and sustainable businesses taking center stage. The current year holds the promise of steadying venture funding levels, fostering a dynamic landscape for innovation and investment.

For more information, download the Escrow.com Domain Investment Index report for Q4/2023 that contains valuable, detailed metrics about the performance of the domain industry’s secure platform.

Copyright © 2025 DomainGang.com · All Rights Reserved.